Diagnosis Coding is Vital to Fair Provider Compensation. Medical groups are signing payer contracts that adjust payment for a contract year based on quality measures, outcomes, utilization and the acuity of care for a patient population. The payor measures acuity of care by reviewing the patient’s age, gender and medical conditions. Where does the payor get the list of medical conditions? Diagnosis codes on claims! Medicare Advantage Plans base incentive payment on Risk Adjustment Factor (RAF) Scores.

Diagnosis Coding is Vital to Fair Funding to Insurance Plans. The purpose of a Risk Adjustment model is to predict the future health care costs for enrollees in Medicare Advantage plans. CMS is then able to provide capitation payments to these plans. Additional funding to the plans in the form of Capitation payments help the health plans to enroll not only healthier individuals but those with chronic conditions or who are more seriously ill.

HHS Payment Goals are to help drive the health care system towards greater value-based purchasing. Rather than continuing to reward volume regardless of quality of care delivered CMS is focused in improving outcomes and reducing cost. Alternative payment models include Accountable Care Organizations (ACOs), bundled payments, and advanced primary care medical homes. Specifically, they want to:

- move 50% of Medicare payments into alternative payment models by the end of 2018.

- move 90% of Medicare payments to a model tied to quality or value by 2018.

Under MACRA (Medicare Access and Chip Reauthorization Act) there is a merge of previously introduced payment incentive programs, including:

- Merit-Based Incentive Program (MIPS)

- Physician Quality Reporting System (PQRS)

- Value-Based Payment Modifier (VBM)

Hierarchical Condition Category Model (HCC) affects Medicare Advantage Plans (aka Medicare Part C) which have been paid under an HCC model since 2004. HCC is a risk adjustment model which identifies patients with serious acute or chronic illnesses and assigns a risk factor score to the beneficiary based on the patient’s demographics and medical history. The government contracts with for-profit insurers to manage health care for these patients, and pays insurers a yearly fee for each member they enroll. The higher the risk score, the higher the annual fee.

Hierarchical Condition Category Model (HCC) Calculations

Each patient is assigned a Risk Adjustment Factor (RAF) score. RAF scores are based on:

- Patient’s age and sex

- Medicaid or disability status

- Total of all chronic conditions and disease interactions

How does HCC Affect Payment? RAF scores are additive. All qualifying diagnoses are included in the RAF score. Risk factors are added to achieve total RAF scores for each patient. RAF scores are predictive, and ICD-10 codes reported this year determine payments for next year. Remember, the payment for the RAF score is from CMS to the Medicare Advantage Plan. Then Plan distributes the incentive bonus to all providers participating in the care of the patient. This payment is in addition to the contractual fee-for-service payments and is paid annually.

It is important to remember that the health status is re-determined each year, therefore codes must be submitted every year to be counted. Past data is not carried forward, and the RAF for each patient is reset every year. Also, payment is made per HCC category (not per diagnosis code). A patient with 4 ICD-10 codes from category E11 for Type II Diabetes Mellitus with complications will only receive credit once for complicated Diabetes Mellitus (HCC 18), and not 4 times that value in the RAF score.

How to Achieve Accurate RAF Payment

The Annual Health Assessment is very important. Consider implementing a program to have a staff member call all Medicare Advantage members to schedule their Annual Wellness Visit and be sure the Risk Assessment, required screenings, and status of all chronic conditions is addressed and documented to qualify as a “reportable” diagnosis. The claim should include accurate and specific diagnosis coding.

Example of How Diagnosis Codes Affect Payment

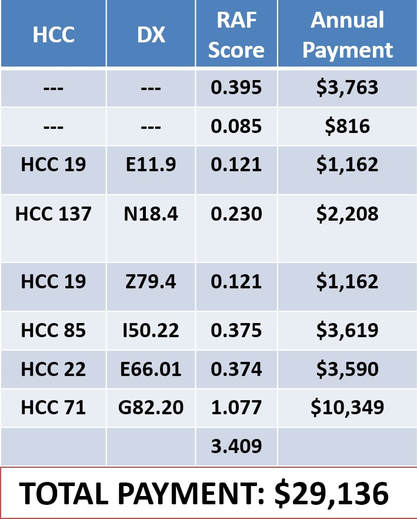

A patient is seen in your office. Patient is a 64-year-old disabled female. She has Type II diabetes and Diabetic Chronic Kidney Disease. The patient also has congestive heart failure and Stage IV CKD (GFR 24 ml/min Filtration). The patient is obese with a BMI of 56, is on insulin and is paraplegic. (see table)

Common HCC Categories

Chronic Kidney Disease

Diabetes Mellitus

Hypertension

Peripheral Arterial Disease (PAD)

Major Depressive Disorders

Stroke and Late effects of prior Stroke

Chronic Conditions

History of Heart Attack

Renal Dialysis Status

Tracheostomy Status

Respirator Dependence

Lower Limb Amputee

Organ Transplant Status

Asymptomatic HIV Status

Protein Calorie Malnutrition

Alcohol Dependence & Drug Dependence

What supports coding for HCC?

Use Current ICD-10 Codes. Effective October 1, 2017 the Centers for Medicare & Medicaid Services (CMS) and the Centers for Disease Control and Prevention (CDC) added or updated approximately 620 diagnosis codes in the 2018 ICD-10-CM coding classification.

- 360 new codes added

- 226 code descriptions revised

- 34 codes changed from valid to invalid

- Validity changes are the result of new codes being added to the classification, changing a previously valid code to an invalid code, creating a new subcategory

- Example: a valid 4-character code now requires 5 characters

- There are also updates to the 2018 ICD-10-CM Official Guidelines for Coding and Reporting that impact medical record documentation, code selection and sequencing.

ICD-10-CM and Documentation – Use the MEAT Acronym. A condition is reportable when the condition was Monitored, Evaluated, Assessed or Treated. Do not report a diagnosis code that was not addressed during the encounter or documented in the note. Our auditors have found errors when the main note does not mention a problem, but ancillary documentation such as medication lists and referrals contains orders for those conditions. The medication list may include Prednisone 5mb PO daily for asthma, but asthma is not mentioned in the history, exam or assessment portion of the note. Referrals for consultations and tests can be found in the note (Ex: chest x-ray confirms pneumonia) without mentioning pneumonia in the assessment portion of the note.

Steps to take in your Practice: Identify HCC Categories that are clinically meaningful. What chronic diseases do your sickest patients have? The HCC diagnosis categories are well defined. Meet with your clinicians and decide which specific diseases/conditions are common. The ICD-10 codes are grouped to each HCC category. There are more than 9,000 ICD-10-CM codes map to 79 HCCs in the current risk adjustment model. Diagnosis codes are excluded from mapping when they do not predict future cost or are vague or variable in diagnosis, coding or treatment. An example is symptom codes or osteoarthritis.

Risk Adjustment Data Validation (RADV) are a reality when participating in an incentive program. CMS audits Medicare Advantage (MA) plans for accuracy of risk-adjustment payments and compares accuracy of coding to medical record. Medicare Advantage (MA) plans can be audited annually. MA plans audit provider records to ensure compliance. If you are selected, you will be required to submit medical records to substantiate coding.

Audits may include the entire note to verify that it supports the level of service billed, medical necessity, and all codes reported. Common errors from RADV audits show that electronic medical record was not authenticated, or medical record does not have legible signature or appropriate credentials

Parting Thoughts. Does your practice have a compliance program? Make it stronger by Including risk adjustment audits to validate clinical documentation. Use audit results to provide education to all clinicians and coders, and continue to audit CPT coding documentation. Continue to monitor patient visits to ensure annual reporting.

RSS Feed

RSS Feed